WIZKID NEWSLETTER (5th-18th Feb)

In here you will find all the necessary information to stay-up-to date with crypto's hottest trends, news and insights.

Everything you need to know compressed into a 5-10 minute read.

Newsletter topics:

- Crypto's hottest and most relevant news

- Technical analysis of the crypto market

- What BTC whales are doing + on-chain analysis

- DeFi update

- NFT update - how to distinguish good from bad NFT projects

MAJOR CRYPTO NEWS

Valkyrie Bitcoin Miners ETF Approved for Nasdaq Listing- The fund began trading last week under the humorous ticker “WGMI", a slang acronym used widely in crypto which stands for 'We're Gonna Make It'. 7th February

US officials seize 3.6B in bitcoin from 2016 Bitfinex hack- Nearly 120,000 BTC was stolen in the hack, some or all of which has been recovered. Who gets reimbursed is still unclear, but the amount of sell pressure this would induce if it's released all at once could be huge. 9th February

First Mover Asia: Cryptos Turn Green on Red-Letter Russia News-Bitcoin increased to nearly $45,000 and major alt-coins rose too after the world's 11th-largest economy announced it would regulate instead of ban cryptocurrencies. 10th February

The Israel Security Authority (isa) has big plans to regulate the fintech space- As a first step it is hosting its first ever fintech hackathon. 14th February

Kazakhstan President Calls for Tax Increase on Crypto Mining: Report- Just weeks after a tax on mining came into effect, the government is looking to raise it fivefold. 8th February

UK tax authority makes first NFT seizure in VAT fraud case- The tax authority made three arrests in connection with a suspected tax evasion using shell companies and false identification. 14th February

Crypto Market Braces for Volatile Week Ahead of Fed’s ‘Emergency Meeting’- The US Federal Reserve (Fed) is set to hold an unscheduled meeting on Monday to discuss interest rates, described by some as an “emergency meeting” and others as a fairly “regular occurrence.” Regardless, the Fed’s unexpected notice has sparked debate in the crypto community over whether the central bank will announce an emergency rate hike - and if so, how high, and how many of them will there be this year. 14th February

Canada's Trudeau Enacts Emergencies Act, and Crypto Is Included- The move by the Canadian prime minister includes an expansion of money-laundering laws to include crowdfunding platforms and cryptocurrency transactions. 15th February

JP Morgan is the first bank in the metaverse- The wallstreet bank has opened a lounge in leading blockchain-based metaverse platform Decentraland ($MANA). 16th February

Canada sanction 34 crypto wallets tied to trucker convoy. Bitcoin, Eth, Litecoin, Monero and Cardano addresses are on the list.

TECHNICAL ANALYSIS

Bitcoin has recovered considerable ground since the previous newsletter edition, almost hitting $46k before rejecting heavily, but building some support between 41k and 42k, while leaving a liquidity gap between 38.8k and 41k. Sentiment has been temporarily restored with the fear and greed index holding back above 50 at 'neutral' for most of last week and this week. Last months index average was at 'extreme fear', below 25. (follow WizKid market sentiments telegram channel for daily updates on the fear & greed index; https://t.me/WizKidSentiments)

Correlation with the S&P has remained strong since discussing BTC correlations in the last newsletter edition. In this edition we will just observe the BTC chart:

BTC 1 Macro

Below we have the 21 month moving average (MA), this has been a key level throughout the history of BTC. It’s a macro momentum indicator. Whenever BTC has held above it the price has reacted bullishly, but every time this level has been broken we’ve experienced additional downside of 40-60%, followed by bottoming and a strong reversal to the upside.

The month of January 2022 tested this 21MA level and in February BTC bounced from the level. If BTC comes back to test the level (currently at $36k) in the next months then bulls should be cautious and possibly look to hedge their long positions. A strong bounce of this MA is an indicator of strength, otherwise weakness

The two ascending horizontal support lines are interesting in regards to how they both hold similar supports and resistances through different macro cycles. The lower line marks the top of the 2013 bull market and two key bottom supports for the 2017 bear market. The upper line marks the top of the 2017 bull market and two key supports of the 2021 bear market / accumulation range - depending on what you prefer to call it. If this pattern plays out a second time then the BTC price forecast for 2022 is very bullish, but this is just one of many scenarios.

BTC 2

Bitcoin has broken the downwards resistance that has squashed price since the November top, and is now meandering around $40-44.5k. Momentum has shifted since the previous newsletter edition and technicals are less bearish. As illustrated with the red drawings BTC has formed a potentially bullish inverse head and shoulders pattern. This would have a price target of approximately 60k should BTC break the neckline ($44-45k = blue horizontal line), although it appears that BTC may have rejected the level and the head and shoulders pattern is being invalidated.

I am personally looking to buy certain Altcoins when BTC gets to the 39-41k levels in expectation of another leg up for the market, while not overexposing myself and managing positions should we fail to find support at between 40-37k. My next buying levels are at 33-34k.

ON-CHAIN ANALYSIS

On-chain tools can provide insight into both supply and demand, and with an increasing bearish sentiment, we now try to find out whether the underlying demand is sufficient to start establishing whether the market has bottomed or is nearing a bottom.

It is important to note that on-chain metrics can be, and have been, manipulated by whales. Nevertheless, here at Wizkid Fund we pick out the statistics that are less likely to be affected by these big players and give a broader understanding of where the market could be heading.

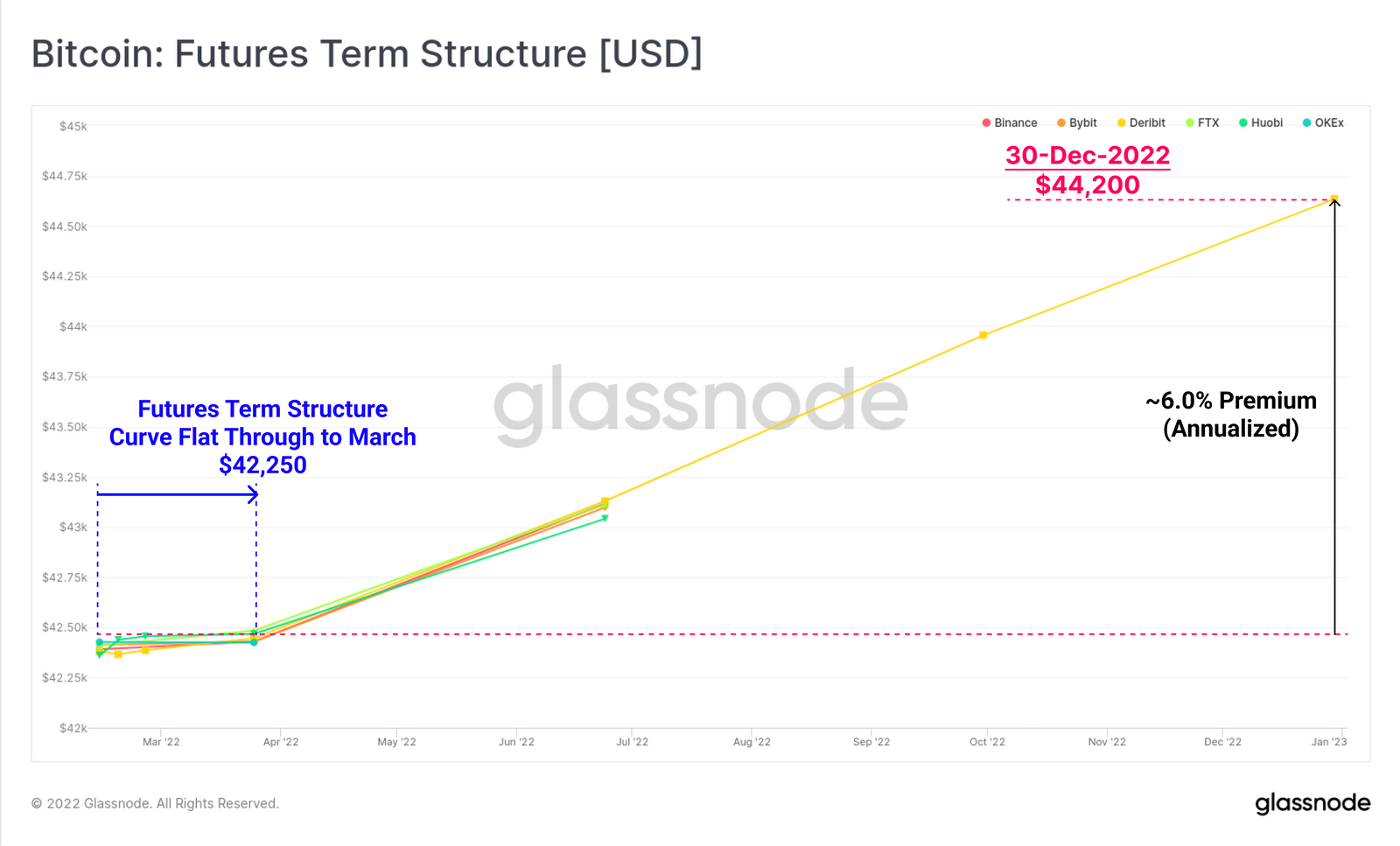

Metric 1 – Bitcoin: Futures Term Structure (USD)

Total futures open interest has now declined from 2.0% to 1.76% of market cap. This is considered a more stable range for the market and was last reached after the de-leveraging event on the 4thof December, 2021.

What the chart above tells us is that there has been notable de-leveraging across the futures market this week. However, this does not seem to be the result of liquidations cascades as we have so frequently witnessed across 2021. It appears that traders are willingly closing their future positions. This indicates that the market appears to be de-risking in response to the vast amount of macro uncertainty in the market.

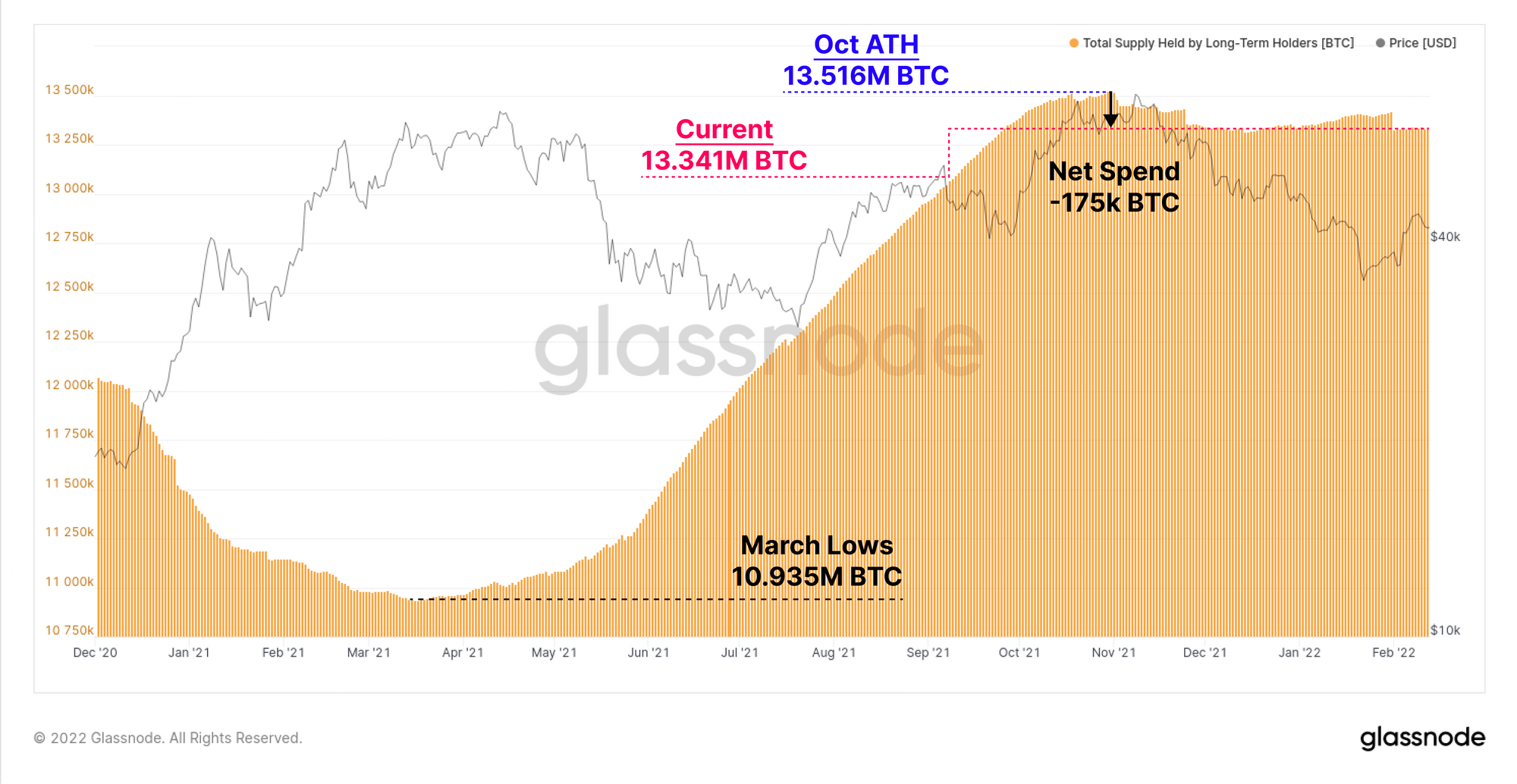

Metric 2 - Total Supply Held by Long-Term Holders

The Long Term holder supply refers to the amount of BTC held by addresses that hold for longer than 155 days without selling. Currently that is 13.3Mil (out of a total of 19Mil total circulating BTC supply). This has been in a sidewards trend since November, meaning the amount of long term holders has hardly throughout the last 3 bearish months. This indicates that conviction of long term BTC bulls is not phased by the bearish economic outlook or the downtrending price.

DeFi Update

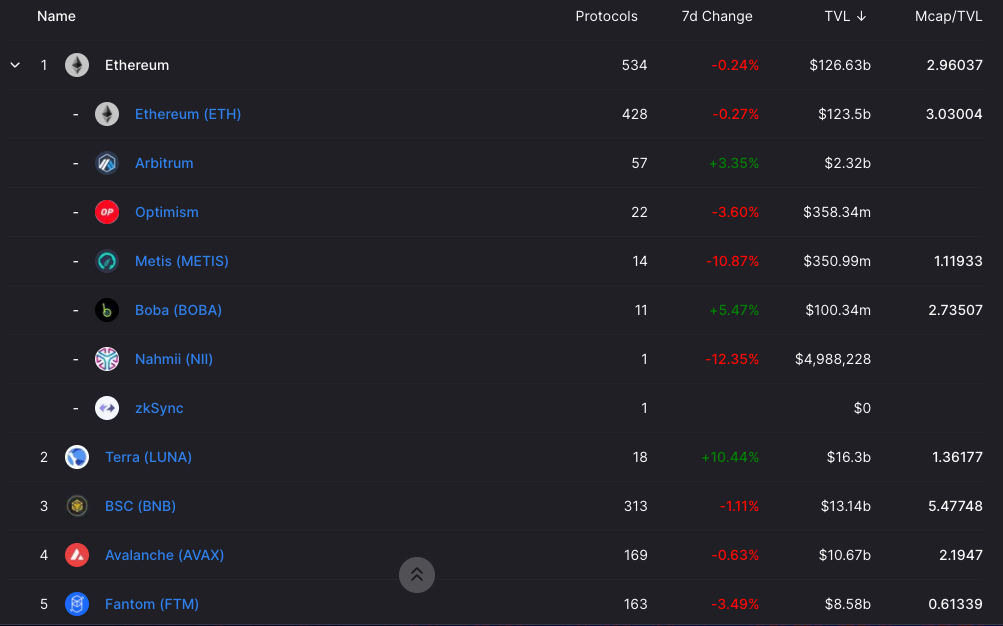

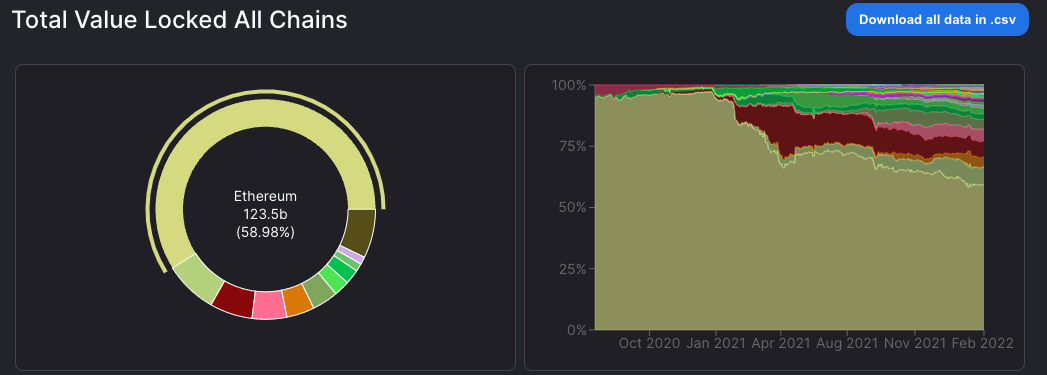

The total value locked (TVL) metrics from DeFillama.com (below) suggests not much movement is happening on-chain. Some of the liquidity lost in January is being recovered, which is an indication of positive sentiment returning into the DeFi sector and crypto in general.

Below is the breakdown of TVL on different chains, the yellow volume being Ethereum. Looking at the chart on the right we can see that ETH has gone from capturing over 90% of the TVL in early 2021, to less than 60% today. This explains the outperformance of alternative chains in 2021; i.e. LUNA, BSC, AVAX, FTM and SOL, which all provided much higher returns than Ethereum.

Will this trend continue into 2022? That depends on the adoption of ETH scaling solutions such as Arbitrum, Optimism, ZkSync and other. While ETH is still the leader in DeFi, retail and venture capital money will continue to circulate the Altcoin space in search of the next Solana or Avalanche. Some options for new chains yet to grow exponentially are Secret Network, LTO and XPR. All powerful solutions in their own right with big backing and currently small market caps.

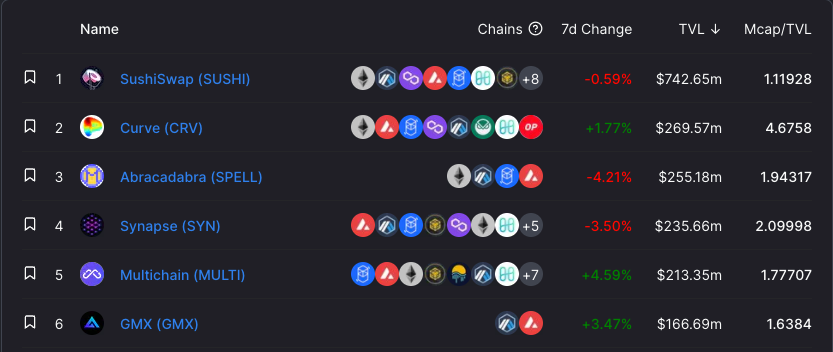

In the previous newsletter I stated that I would discuss Layer2; Arbitrum, and the projects on it more in depth. Upon further research it seems that most of the activity on Arbitrum is coming from Ethereum main-chain native dApps such as Sushiswap, Curve and Abracadabra. As seen below, the only Arbitrum native DeFi project with notable TVL is GMX (In which I've invested).

JonesDAO (discussed in previous Newsletter) and DOPEX are the most interesting projects on Arbitrum right now, and also have the most trading volume. They work together, JonesDAO being a decentralised hedge fund, and DOPEX being the decentralised options protocol which Jones uses to invest client funds.

DOPEX is a smart DeFi suite with various investment instruments such as single sided staking options. These allow users to take a bet on future price of an asset and simultaneously earn high liquidity provision rewards on that position while it is open, despite the end outcome of the options call. As well as providing advanced investment tools, DOPEX is helping provide liquidity to the Arbitrum ecosystem.

JonesDAO is a passive income tool which allows users to deposit their funds into the protocol where the Jones team will utilise and actively manage options positions for them via DOPEX.

Here is the Ethereum>Arbitrum bridge and a list of Ethereum apps which have been made available on Arbitrum, for those who wish to use Ethereum DeFi tools with cheap and instant transactions: https://portal.arbitrum.one//

Hot DeFi projects;

New Order $NEWO - A very active and new DeFi project on Ethereum, aiming to be a community led venture capital DAO. By staking the NEWO token, participants will receive 100%+APY; and get airdropped tokens of New Orders incubator projects. They are operating as a venture capital treasury, somewhat like Wonderland ($TIME) but with much more realistic goals and expectations and a transparent roadmap towards becoming truly decentralised. Something Wonderland never really achieved. NEWO is also comparable to MakerDAO and Seedify. They have an extensive list of big partners; including Chainlink, Terra, Solana, Curve, Algorand and Olympus. My only issue is a lack of information on the team, and the fact that it is currently entirely centralised. At a $20mil market cap and with 20+ projects in the pipeline for incubation in 2022 it seems like a steal. WizKid have made a full token report on NEWO (available on request).

Solidly - Super low cost decentralised exchange (DEX) on Fantom launched by Andre Cronje. Reworked incentives design which should result in deeper liquidity and cheaper swap rates. Something to watch in the future, as Andre Cronje projects usually do extremely well. There is no token yet, although the token will be called $SOLID and will be earned (farmed) by providing liquidity to SOLIDLY DEX.

The majority of the alternative chain projects I discuss here can be charted with this tool: https://dexscreener.com/

NFTs

The NFT market has become one of the fastest growing markets in the last year. Unfortunately, this also attracts a lot of scams and cash-grabs. Here at WizKid we have compiled a list of the 3 most important factors to analyse before investing in an NFT project.

How do we distinguish the good from the bad NFT projects?

Team:

This is an important one and 80% of your research should be conducted here first. To be completely truthful there is no real reason for a team to be anonymous when there are millions of dollars on the line. There are some exceptions such as Cryptocurrency being illegal in the nation where the team is based but that’s honestly about it. If the team really does believe in the longevity of the project, they will most likely “dox” themselves.

Ideally you are looking for team members with a track record of successfully launching NFT projects or businesses in the past. Any form of verification is useful here. If the team is doxxed, we will browse their online identities e.g. LinkedIn, Twitter, Facebook etc, to confirm whether their claims are valid.

It is important to not lack on this end as it has become common practice for scamming teams to hire paid actors to represent as the team members. However, if you are thorough with your research you might save yourself, and others, a lot of money.

In addition, a doxxed team, regardless of skillset and background, adds a layer of trust and conviction.

Dox/doxxed – A term used to clarify whether an individual’s identity is public.

e.g. “yes the team is doxxed” – yes the teams identity is public.

Socials:

A big red flag is when an NFT project launches their socials and accumulates a following of 20.000-50.000 people on Twitter and Instagram within 1-2 days. In 99% of the cases this indicates that the project has bought followers meaning they are artificially creating hype and “FOMO”. Incentivizing “fear of missing out” makes humans think irrationally and, in this case, potentially invest in projects that are full of red flags.

Here is a tool that we use to identify whether the engagement on their twitter is from real people or bots. https://www.twitteraudit.com/

Another red flag is celebrity endorsements. This is usually done to add credibility to a project but most people do not know how simple it is to pay-off a celebrity. For example, you can hire “Thiago Silva” who is one of the top football players in the world, for just 500$.

https://www.cameo.com/thiagosilva

A good project will grow slowly and organically. Ideally hosting a lot of AMA’s and Twitter Spaces. Although this may seem less attractive to the majority, this is EXACTLY what we are looking for.

Mint Prices:

Minting refers to the process by which your digital art or digital content becomes issued on the blockchain e.g. created on the Ethereum Blockchain. The mint is the initial purchase from the NFT creator.

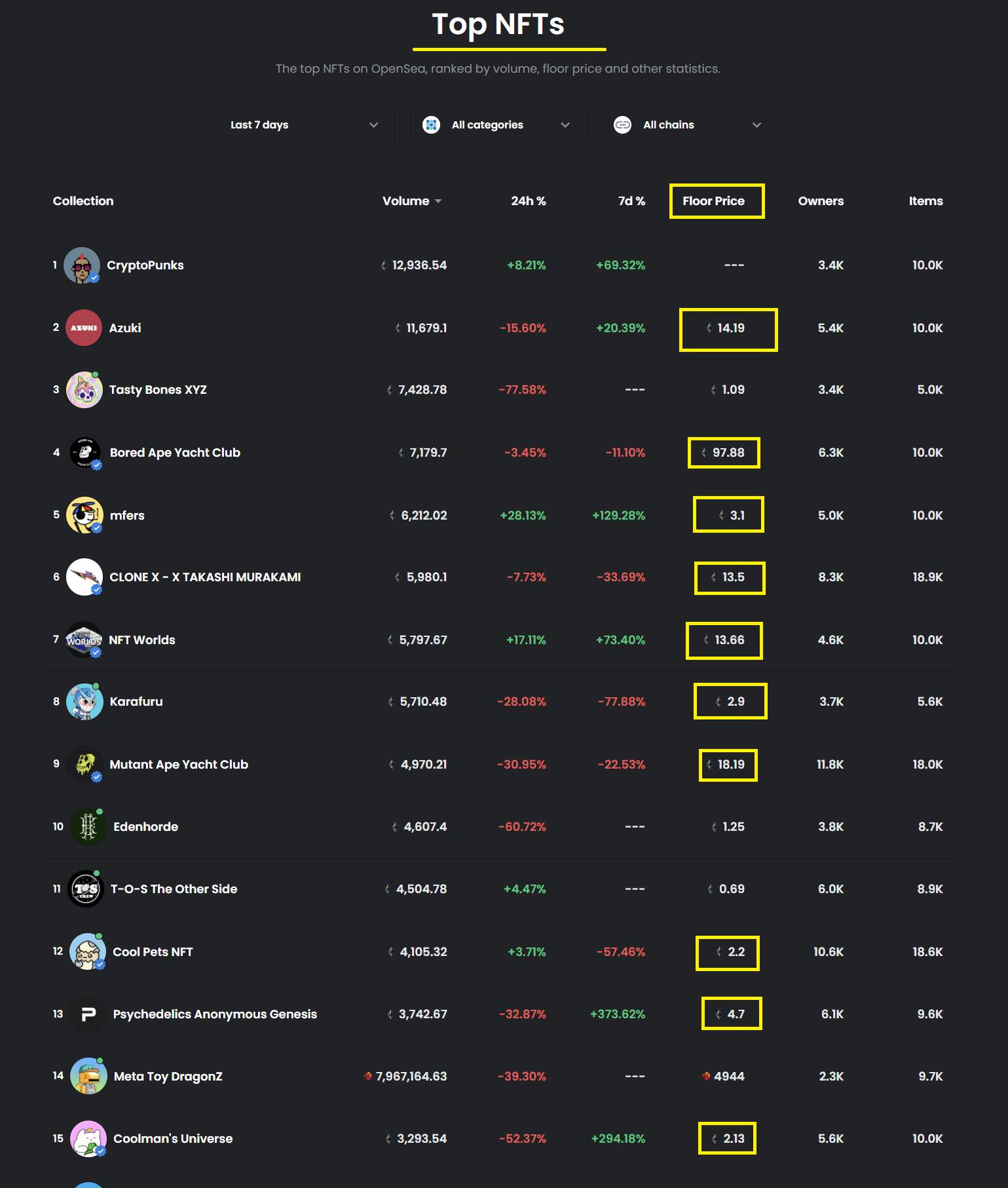

Only 6 months ago it was routine to keep mint prices around 0.02-0.1 Ethereum, roughly 60-300$. However, over the last 2-3 months this has changed with normal mint prices ranging from 0.3-3 Ethereum (1200$-8800$). This is due to the prices of top projects having massively inflated over the last 6 months.

For example, Azukis, CoolCats, CrypToadz, mfers, Karafuru have all got a floor price of 3-15 Ethereum meaning it has become normal for projects to trade within those ranges. Therefore, this has allowed scammers to sell bigger dreams to potential investors and consequently allowed them to extract more money out of the market than ever before.

To put this into perspective. Good scammers may have previously been able to extract around $2,000,000 from a collection, whereas now a scammer is able to extract anywhere between $10M-$20M from one project.

We are very cautious when we see projects with mint prices above 0.3 Ethereum and/or Dutch auctions starting above 1 Ethereum.

Ideally, you want to find projects such as CoolCats, BAYC or Tasty Bones which had their mint price around 0.02-0.08 Ethereum. Not only does this demonstrate to us that the founders truly care about building a community and the longevity of the project. But It also increases the likelihood of original minters/investors to be in profit thus creating more loyal fans to weather the storms and lulls in the market.

To conclude, the number of buyers in the NFT space is growing by 30% each month, this means that the NFT audience will essentially double every 3 months if we keep up this pace. This means that there will be a huge inflow of individuals who are blind to the risks of investing in NFTs. It is our responsibility as a community to understand the risks in the space and transfer this knowledge to the new.

Be careful and make sure to properly analyse projects before investing!

A word from WizKid -

Thank you for reading and don't forget to subscribe to be notified for the next release.

- WizKid Team

Telegram daily market updates channel: https://t.me/WizKidSentiments

Telegram Ibiza Crypto Community group: https://t.me/IbizaCryptoCommunity

The information provided herein is for informational purposes only. Nothing herein shall be construed to be financial legal or tax advice. The content recommended is solely the opinions of the speaker who is not a licensed financial advisor or registered investment advisor. Trading cryptocurrencies poses considerable risk of loss. The speaker does not guarantee any particular outcome.